Note: This is the fourth in a series of posts about the City of Round Rock’s proposed fiscal 2021 budget and tax rate.

Update: The City Council approved on first reading the Fiscal Year 2021 budget and tax rate on Aug. 27.

Building additional capacity for Round Rock’s future transportation needs while also making sure to take care of existing streets requires considerable resources, i.e., money. The proposed fiscal year 2021 budget includes $91.7 million in capital spending for transportation.

The spending aligns with one of the City Council’s top strategic goals – City Infrastructure: Today and for Tomorrow. It also addresses what our citizens have told us in every biennial survey we’ve done since 1998: Traffic is the biggest problem facing Round Rock.

Of course, some of the price tag for tackling a problem of this magnitude falls on residential and commercial property taxpayers.

The City embarked on a five-year, $240-million road building program called Driving Progress in 2018. The program is funded in part by bonds backed by property taxes, and will improve traffic flows on major corridors like Gattis School Road and University Boulevard.

In April 2019, the City issued $30 million in certificates of obligation (COs) to kick off funding for the program. This past April, the City Council approved the second round of $30 million in COs. Because lending markets were hard hit by the COVID-19 pandemic, the City was able to borrow the second $30 million for a significantly lower interest cost than the first $30 million.

That means less impact on the proposed property tax rate, but an impact nonetheless. Of the proposed 1.3 cent tax increase, 0.3 cents goes to paying back the second round of COs.

The balance of the potential increase – the City Council will make its first vote on the tax rate at its Thursday, Aug. 27 meeting – is earmarked to pay for neighborhood street maintenance. You can read about the street maintenance/tax impact issue in our prior budget blog post.

Lest you think the entire burden for paying for new roads is being borne by property taxes, remember the City Council approved Roadway Impact Fees in March 2019, which are paid by developers to cover some of the costs of expanding our transportation network necessitated by their projects.

About the proposed tax rate

The proposed property tax rate is 43.9 cents, the same as the current tax rate. It’s an increase of 3.2 percent above the “no new revenue” tax rate of 42.5 cents, which takes into account the 2.8 percent growth in existing property values from last year.

At the proposed rate, the owner of a median valued home would pay $94 per month in City property taxes, or $3 more than last year. The median home value in Round Rock for FY 2021 is $256,347.

For those of you wondering why the City’s growth won’t pay for the needed transportation projects, here’s your answer: New property valued at $294 million was added to the property tax roll since last year. This amount of new property will generate $1.3 million in additional property tax revenues.

Sales tax revenue continues to be a critical source for funding City services – as well as $86 million worth of transportation infrastructure in the proposed budget – but we’ll talk in more detail about that in next week’s budget blog. Spoiler alert: It’s a big deal. (Can’t wait? Read more about it here.)

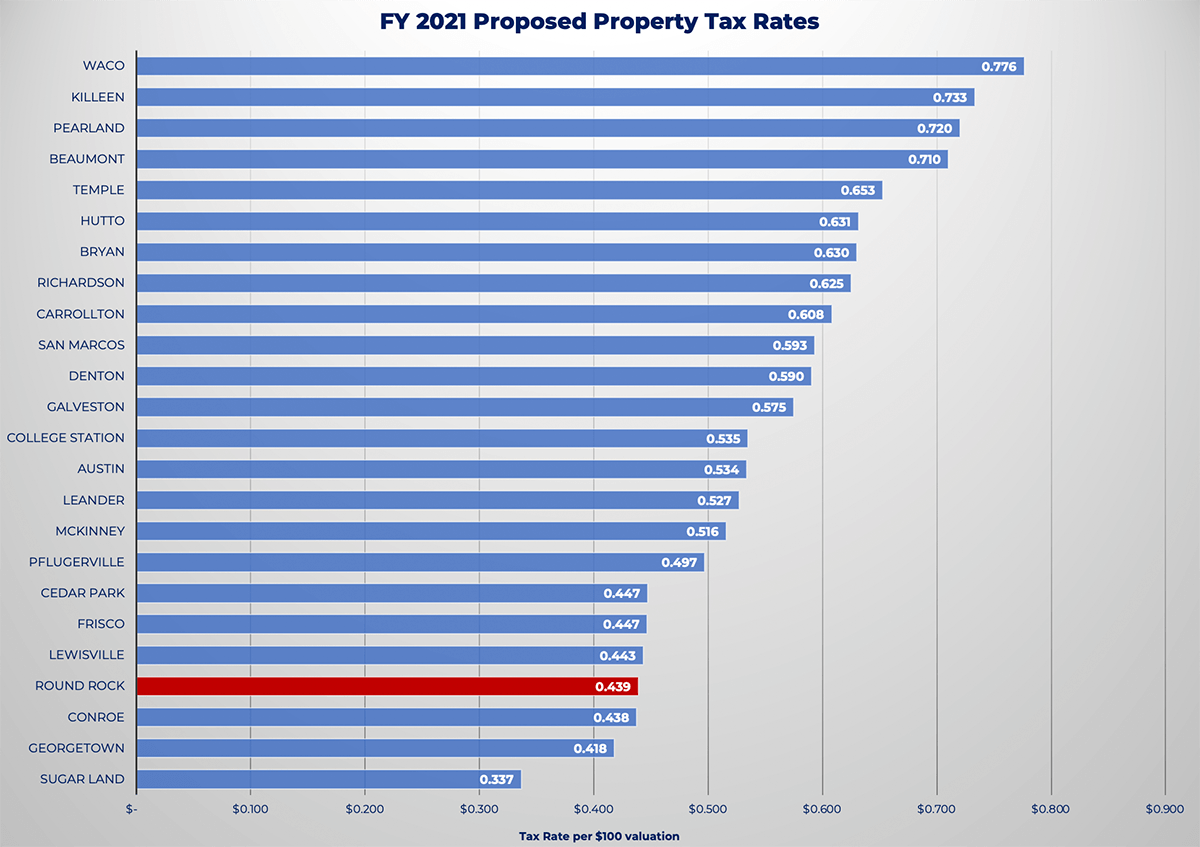

While no one likes paying more in property taxes, it helps to have some perspective. Round Rock’s property tax rate is among the lowest in the Texas, as the chart below shows, and few cities receive the kind of recognition we do for affordability and livability.

Building additional roadway capacity and taking care of what’s already built isn’t easy – or cheap – but Round Rock has found a way to do it that minimizes the impact on the tax rate.